What’s Passive Income Trading?

In our definition, passive income trading is making the best use of experts’ abilities (both human and machine) to generate regular profits from financial trading with minimum effort to maintain it, rather than executing every trade yourself, namely, active trading.

Financial trading can involve Forex, Equity (stocks), Bonds, CFDS, and Commodities, though we mainly focus on Forex trading here.

We say Use Experts’ Ability, and we have the following three specific methods to do passive income trading;

- Copy Trading (Forex / Stock / Commodity): Copy trading enables you to automatically copy the trades in your account from the traders you decide to follow via the social trading platform, with virtually No Cost. eToro and ZuluTrade are said to be the most established platforms. You can diversify your assets by following multiple traders, which forms a new type of portfolio, a.k.a. People-Based Portfolios.

- PAMM (Forex): The Percentage Allocation Management Module is a technological solution for Managed Accounts. It allows the money manager to trade on one trading platform to manage an unlimited number of managed accounts, saving many costs. Currently, the best PAMM broker seems to be FXOpen. Importantly, your money never leaves your hands; it is kept in your brokerage account under your name.

- Robot / EA – Expert Advisor: (Forex): A Forex robot or EA (Expert Advisor) is a piece of software (algorithm) that analyses the market based on the settings entered by the user. The user does not need to make any trading decisions. Profitable Forex traders usually buy and sell currencies throughout the day, thus a robot can be extremely valuable because the software will manage all your trades even while you’re sleeping.

Why Do We Suggest Passive Income Trading?

Financial Trading, such as Forex Trading, is a high-risk economic activity. Sadly, the high exit rate of inexperienced traders proves the difficulties of making Forex trading profitable.

95% of All Forex Traders Fail – Harsh Reality

Given the increasing number of online brokers, there have been many individual traders in the Stock and Forex markets. Remember that Forex (spot forex market) is a Zero-Sum Game; it’s a negative-sum game by taking the brokerage’s mark-up spread/commission.

Therefore, it’s a natural consequence that very skilled traders (those who committed strong efforts to go through proper training) and institutional traders possessing information advantage beat the average and inexperienced retail traders. So, we can describe this situation as institutional traders being the casino (house), whereas retail traders are the gamblers. Given the House Edge, the Gamblers Can’t Beat the Casino. That said, 95% of all traders fail, a statistical number often found on the internet, and reportedly, 80% of all day traders quit within the first two years.

The Loss Accounts in Forex Brokers

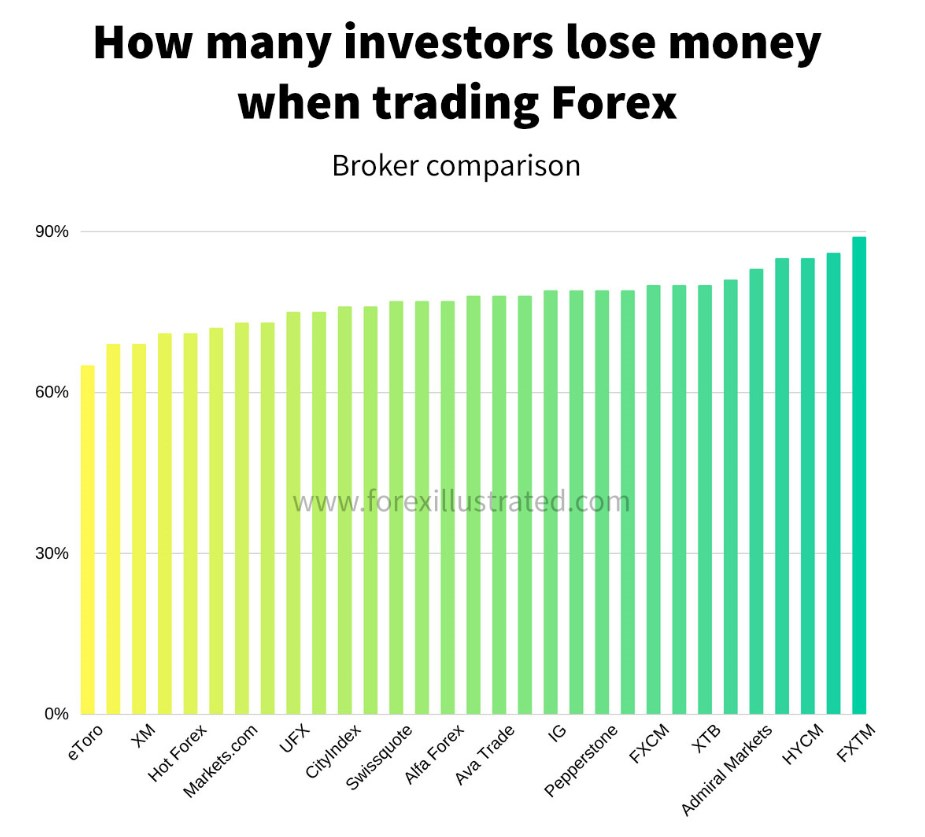

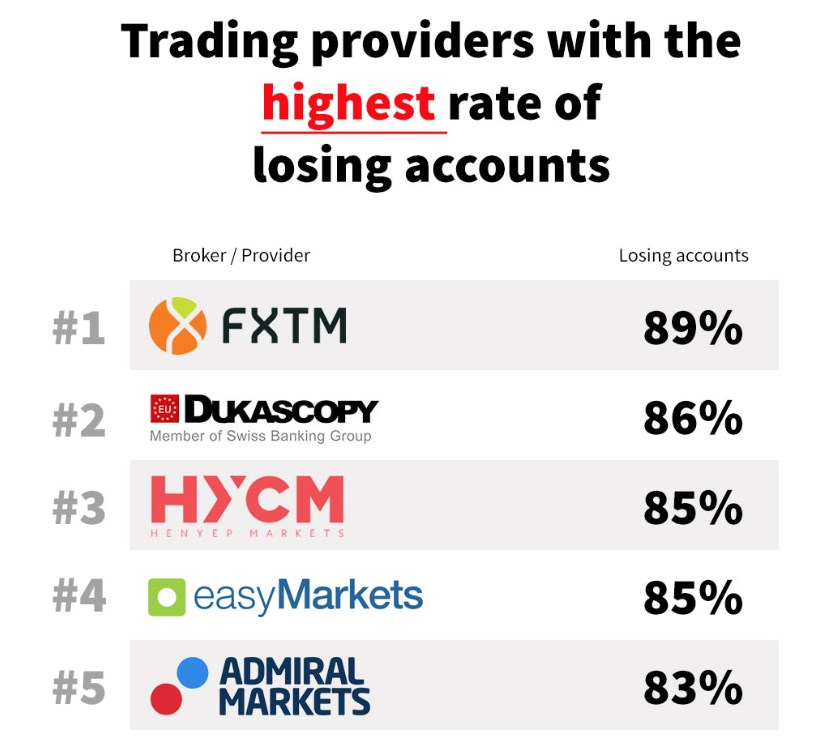

Then, let’s see the hard facts related to the losing accounts based on the officially published numbers. With the new European regulations that came into effect on 1 August 2018, brokers are required to clearly display in their marketing messages the percentage of their clients who lose money. For example, “75% of retail investor accounts lose money when trading CFDS with this provider.”

It turns out that the losing account percentage varies from 65% to 89%. The average rate of lost accounts is 77%.

These brokers may attract the least experienced traders and fail to provide them with sufficient learning and training tools. The above results are combined for skilled/institutional traders and retail traders; therefore, we assume the 95% loss could be similar for only retail traders.

Social/Copy Trading Advantage

It also highlights;

As you can see in the image above, eToro stands out from the crowd with the lowest percentage of losing accounts. A 65% loss rate means that 35% of eToro users are profitable. That is 3 times more than the worst-performing brokers and almost 9 times more than the folk legend predicted. What could be the reason behind the high profitability rate of eToro? The main difference of eToro from other trading providers is the possibility to connect with other traders, discuss trading strategies, and use their patented CopyTrader™ technology to copy the trades of successful traders automatically. This works!

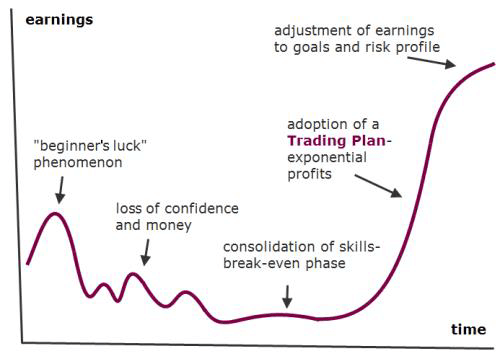

Equity Curve To Become a Seasoned Trader

The graph below shows a typical equity curve during a currency trader’s first decade, and 80% of traders are quite at the edge of losing Confidence and Money.

Importantly, you must spend further years of complex learning and cost (both time and money) until you can see a decent profit. Most of you don’t have much time, so we will not suggest risky, uncertain self-trading but focus on making the best use of Top Traders’ Abilities.

However, over 97% of online programs offering high-yield returns in a pooled fund structure are widely believed to be scams. They disguise and tantalize you with easy profit, and you should never mistake them for good income opportunities.

It’s essential to avoid any schemes that leave your money in the hands of others. Instead, focus on schemes that allow you to keep your money 100% under your own control.

Some Insights on Why Most Traders Lose Money

Excuse me for repeating myself, it’s challenging for retail traders to win unless they have the exemplary commitment & training, let me provide you with its rationale by quoting “Scientist Discovered Why Most Traders Lose Money – 24 Surprising Statistics” as follows;

24 Surprising Statistics

“95% of all traders fail” is the most commonly used trading-related statistic online. But no research paper proves this number is correct. Research even suggests that the actual figure is much, much higher.

In the following article, we’ll show you 24 very surprising statistics economic scientists discovered by analyzing actual broker data and traders’ performance. Some explain very well why most traders lose money.

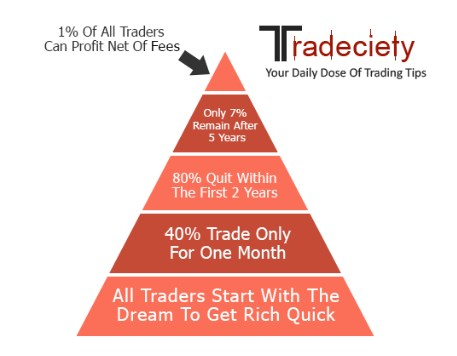

- 80% of all-day traders quit within the first two years.

- Among all day traders, nearly 40% of day traders trade for only one month. Within three years, only 13% continue to day trade. After five years, only 7% remain.

- Traders sell winners at a 50% higher rate than losers. 60% of sales are winners, while 40% are losers.

- The average individual investor underperforms a market index by 1.5% per year, and active traders underperform by 6.5% annually.

- Day traders with strong past performance often earn strong returns in the future, though only about 1% of all day traders are able to predictably profit net of fees.

- Traders with up to a 10-year negative track record continue to trade. This suggests that day traders continue to trade when they receive a negative signal regarding their ability.

- Profitable day traders comprise a small proportion of all traders – 1.6% in the average year. However, these active day traders account for 12% of daily trading activity.

- Among all traders, profitable traders increase their trading more than unprofitable day traders.

- Poor individuals tend to spend a larger proportion of their income on lottery purchases, and their demand for lottery tickets increases with a decline in their income.

- Investors with a significant differential between their existing economic conditions and aspiration levels hold riskier stocks in their portfolios.

- Men trade more than women. And unmarried men trade more than married men.

- Poor, young men who live in urban areas and belong to specific minority groups invest more in stocks with lottery-type features.

- Within each income group, gamblers underperform non-gamblers.

- Investors tend to sell winning investments while holding on to their losing investments.

- Trading in Taiwan dropped by about 25% when a lottery was introduced in April 2002.

- During periods with substantial lottery jackpots, individual investor trading declines.

- Investors are more likely to repurchase a stock they sold for a profit than one previously sold for a loss.

- An increase in search frequency predicts higher returns in the following two weeks.

- Individual investors trade more actively when their most recent trades were successful.

- Traders don’t learn about trading. “Trading to learn” is no more rational or profitable than playing roulette for the individual investor.

- The average day trader loses a considerable margin after adjusting for transaction costs.

- In Taiwan, the losses of individual investors are about 2% of GDP.

- Investors are overweight stocks in the industry in which they are employed.

- Traders with a high IQ tend to hold more mutual funds and a larger number of stocks, which means they benefit more from diversification.

Conclusion: Why Most Traders Lose Money Is Not Surprising Anymore

After reviewing these 24 statistics, it’s clear why traders fail. More often than not, trading decisions are not based on sound research or tested trading methods but on emotions, the need for entertainment, and the hope to make a million dollars in your underwear. What traders always forget is that trading is a profession that requires skills that need to be developed over time.

Therefore, be mindful of your trading decisions and your view of trading. Don’t expect to be a millionaire by the end of the year, but keep in mind the possibilities of trading online.

Passive Trading Income Summary

Human emotions, especially fear and greed, are the biggest obstacles to successful trading.

Fear becomes an irrational force when it prevents the trader from taking required trades or hesitating too long, in particular after having suffered a losing trade, or it prevents a trader from closing a bad trade with a loss (simple Behavioural Economics).

Oppositely, Greed causes traders to make random trades or hold on to positions longer than their trading system dictates. Humans are also plagued with ego and bias. They see what they want to see from charts and indicators, look for confirmation for their hunches, and are unable to see things critically and objectively.

So long as real money is at stake, it is very difficult for humans to overcome these negative emotions and biases. You need to understand trading psychology, which is very important.

Only Machines and very Skilled Traders can solve the problems unless you devote yourself to training to become a Skilled Trader.