Income Diversification As Your Contingency Plan

Job security is an illusion. You must develop ways to safely and reliably diversify your income online for a rainy day.

What does diversifying your income mean?

Income diversification is cultivating more than one source of income. Means making extra money in multiple streams so that you aren’t at the complete mercy of one set of circumstances. This is all about creating your financial safety net.

Well, I know—easier said than done. But we’d better prepare the Contingency Plan through Income Diversity. Different people have different opinions and ideas about diversifying your income, and there are many “10 ways to make extra income” posts on the Internet.

Income Diversification – Essential Underlying Concepts

However, people often find most of them challenging to continue, because I feel they don’t satisfy the following three basic underlying concepts for multiple income creation:

1. Don’t bother your time so much

Assuming you have a daily job, extra income should come from side earnings (otherwise, it can’t be extra income). It should not negatively affect your mainstream work. Whatever you do will compete for your time, attention, and resources. We have only 24 hours a day; therefore, it’s wise to earn as much as possible from tasks that are ideally passive or semi-passive.

2. Enjoyable and /or Informative

We’re human beings and have two fundamental desires: to Feel Good and to Learn. To keep you constantly motivated and make the task sustainable, it should be related to what you are familiar with and like to do, e.g., your hobby or favourite stuff, or something you’re interested in and want to know better.

3. Little Correlation with your primary income

Income diversification is all about risk aversion, often said as Don’t put all your eggs in one basket. If you work for a construction company, don’t try to get extra money from the real estate area, such as property-related company stock. If the economy slows down and goes into recession, you may lose everything. In other words, selecting the opportunity with no or little correlation with your other incomes is essential from a risk management perspective.

Clever Ways To Diversify Your Income Streams

Having taken all the above 1-3 concepts into account, the following approaches sound viable:

1) Passive Trading

Make the best use of the Expertise of Experts in Forex / Financial Trading to save your time and increase the chance of success rather than doing everything from scratch on your own, and to sharpen your radar on global Political & Economic climate/movements means to increase your knowledge & insights on international affairs as well as improve your financial literacy.

2) Advantage Gambling

Enjoy Sports Events to get more fun & excitement through your favourite sports events.

3) Skill-Oriented Game

Play a Highly Strategic and mathematical Game to develop logical thinking and emotional intelligence. This will increase your brain power, namely activate your brain, which will help suppress ageing by combating Alzheimer’s disease, etc., and help your one activities achieve better results.

Generally speaking, all 1)—3) have very little correlation with other asset classes such as Stocks, Bonds, Commodities, Real Estate and the income from your daily job unless you work for a financial trading-related firm like a forex broker or betting bookmakers.

Income Diversification First Concern – Gambling

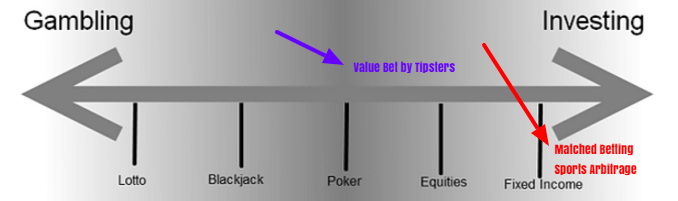

Regarding Advantage Play, no matter what we explain, some of you may still say I don’t do gambling. Don’t be obsessed with such prejudice. Let me show you two examples that prove Advantage Play is Not Gambling.

Matched Betting

This method of Sports Betting has been catching on worldwide over the last 10 years. Nearly 300,000 ordinary people in the UK and Ireland alone are supposed to use this method to make fast extra money on the side. It has been introduced in several established media outlets, such as The Guardian – Free bets mean you can clean up as bookies meet their match.

Why is it Risk-Free? Go to the TSC Publishing page to access our eBook, which comprehensively explains to hedge all your bets & guarantee the Profits from Bookies.

Value Vetting

Have you heard the name of Patrick Veitch? Patrich is the man most feared by British bookmakers. The Daily Mail, as well as The Telegraph, reported that Dubbed Enemy Number One. Patrick Veitch went from being a Cambridge University mathematics scholar to the man feared by the bookmakers. He works 80 hours a week on his system and uses various agents to place his money on horse racing. He commented that horse racing is a multi-layered conundrum. What you’re looking for is the factor the bookmakers have entirely wrong. That takes strategic thinking, experience, and thoroughness. The fact of the matter is that there is no shortcut. The only way to win is through sheer hard work.

The rewards can be seen in his splendid townhouse in the north of England, an innovative London pad, a helicopter, and a Ferrari. He uses his intelligence and mathematical brain to analyse form and spot holes in bookmakers’ odds.

Unfortunately, Patrick doesn’t produce tips, but there are a few excellent Tipsters who constantly produce Value Bets, not as bright as Patrick’s, though, that will help you make fast extra money (so, in fact, it’s also passive trading/betting).

Are We Yet Trying To Gamble?

Many of you will still say Patrick is a scarce and chosen gifted man. Yes, such a vast win must be rare.

However, there are also a bunch of people (5% or more, depending on the categories) who continuously win and make a living betting.

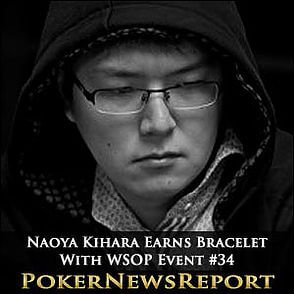

So, let’s define “Gamble”. Mr. Naoya Kihara, the first Japanese Professional Porker Champion defines that gamble as Putting Money Into Something With Negative Expected Value. This means taking excessive risks to end up with a loss. Poker is not a gamble for Mr. Kihara because he plays only games for which the expected value is positive. That’s precisely the underlying concept of our Advantage Plays.

Everything is based on the theory of probability and expectations, which are gauged in EV (Expected Value), as I will explain later.

A Bit More about Expected Value

Very briefly, imagine you find a coin flip game stall at a festival, and assume the storekeeper offers that you will receive £10 if you win. Then what is the maximum stake you should accept to play this game?

The probability of a head or a tail is 50:50, which means your winning probability is also 50:50, or 50%. Then your E(X) = $10 (if win) x 50% + $0 (if loose) x 50% = £5 (see the formula below).

Therefore, when the stake required is less than £5, like £4, you should play this game; however, if it is more significant than £5, such as £6, you should not participate in the game.

Please note that it’s possible that you may keep winning over 10 times consecutively under a £6 stake based on simple luck, called Variance. But in the long run, say, playing 100 times, the probability theory surely applies, and you will lose, vice versa.

EV Formula

The handful of constant winners are not gamblers but stick to this principle. When it comes to Sports Betting, the expected value formula can be expressed as:

Expected Value (EV) = (Probability of Winning) x (Amount Won per Bet) – (Probability of Losing) x (Amount Lost per Bet)

For the above coin case, if you stake £6 to participate in the game your EV = £5 of E(X) – £6 of Stake = – £1 while if you stake £4 to participate in the game your EV = £5 of E(X) – £4 of Stake = + £1. The bottom line is that if you bet on a Positive EV, namely Value Betting, it is no longer a gamble but something you will surely make in the long term. Here, the Law of Large Numbers (LLM) applies.

Income Diversification Second Concern – Safety

Ponzi Free

Regarding passive trading, we listed the PAMM (managed) account, Social Network Copy Trading, & Software (robot) System. Why?

In the Internet age, wherever you are, you can access the Forex Market and Sports Events 24 hrs/day worldwide through online Forex Brokers and online Bookmakers. You can make fast extra money online by using Professionals online.

However, it’s widely believed that over 90% of online investment programs and business opportunities, such as network marketing, are scams or highly short-lived due to their poorly constructed business models. So, always resort to common sense and ignore tantalising promises of Easy Profits and Get Rich Quick advertising. Let me elaborate on this security issue because it’s imperative. Regarding Passive Income, Pooled Funds are among the most popular investment vehicles. Any funds in which multiple investors contribute assets and hold them as a group are classified as pooled funds, such as a mutual fund, unit trust, hedge fund, etc.

A professional trader manages these funds, so you don’t need any education or skills to trade for yourself; they do everything for you.

However, people are often tricked by Ponzi Schemes, a widespread fraud in Pooled Fund Structures represented by Bernie Madoff’s $60 billion con. This is because your money is not in your account but someone else’s (trading company, etc.) account.

On the other hand, a Managed Trading Account, including PAMM (Percentage Allocation Management Module), is an investment account that contains a portfolio of securities owned by an individual investor. This means you directly own the securities, but they are chosen and traded by a hired professional money manager on your behalf (100% Passive). Trading can be managed by humans, namely discretionary trading or an automated technique, such as using a robot that can eliminate all emotion. All your money never leaves your hand in the Managed account, but is kept in your brokerage account under your name. You grant permission to the experienced traders to access your account to trade on your behalf. However, the permissions are limited to selling only, and he cannot deposit any extra funds or withdraw from the account.

Let me stress that you are the account proprietor (Ponzi Free). Generally speaking, managed accounts demand at least $100k or more to agree to work only for you. Lately, many managed accounts offer the advantage of hiring with smaller amounts, but of course, the broker won’t work only for you. However, the new technology of PAMM—Percentage Allocation Management Module—provides a solution that allows the trader to manage an unlimited number of managed accounts simultaneously on one trading platform. The results of traders’ activities (trades, profit, and loss) are allocated between managed accounts according to the ratio. The bottom line is that PAAMS allows small investors to enjoy the security and return of managed accounts starting from $100 or less.

So, let me summarise the key characteristics/benefits of Managed Account & PAMM as follows:

Own control

- Only the account owner can deposit and withdraw investment funds at any time.

- The owner can revoke the right of the investment manager to trade the account.

- The owner may close the account at the end of any trading week

Transparency

- The owner has real-time access to their account and can view all trading activity therein.

More Secure Ways

There is no room for Ponzi scam tricks regarding social network copy trading and robot trading (both are auto-trading, so they are passive income). You can manage your accounts using signals from experts or robots, allowing you to do autopilot trading. Never get your money out of your account, and never get any others to access your account. Regarding Sports Betting, unlike FX trading, incredibly few pooled funds exist. You should and can bet in your bookmaker account manually, but some sophisticated software will make the process easier, especially for Sports Arbitrage. For value betting, you do it basically without any input from your brain, but by following the instructions you receive for every bet from a tipster or a computer system. Your decision-making rests with determining which bet signals to take.

Let me stress that when you engage in Online Money-Making Programmes, it is better to avoid the Pooled Fund, given the availability of so many other safer choices.

Diversify Your Income – Wrap Up

3 Pillar Methods & Vision

The best part of the approach explained in this guide is that you can start building additional income streams by satisfying the three elements of 1. Maintaining your full-time job, 2. Enjoyable and/or Informative Task, and 3. Little Correlation with your primary income. We all have different preferences, so our decisions will vary significantly. Whatever you decide to do or not to do, your contentment and satisfaction genuinely matter.